The momentum has been building for at least two years, but in the last few months of 2016 the signs were unmistakable: we are on the verge of radical changes that will change forever how we distribute and watch news and entertainment. Thanks to the widespread adoption of broadband the Internet average speed has now reached 6MB/s worldwide according to Akamai, and this increased capacity has translated into a growth of video streaming over the web.

Digital video streaming is changing not only the way we produce and consume entertainment, but also the way we communicate. Ironically those who were strongly positioned in the past are the ones deemed to loose the most as they remain constrained by revenue models that will be outmoded soon. Hasn’t this always been the case since the times of Zeus and Uranus?

What used to be the exclusive playground of a few very rich media corporations that could afford the equipment, logistics and talent required to produce live news, in the last decade has become more accessible, until now when anyone with a smartphone and a decent connection can broadcast to a worldwide audience. We have seen a clear example of this new information model in the recent mobilization for the North Dakota Access Pipeline, where the big networks arrived several weeks after the audience had been building on social media. But not only mainstream news are suffering from the rise of digital video streaming, more and more television viewers are “cutting the cord” abandoning traditional broadcast channels (cable and air) to watch ad-free subscription channels like Netflix, Amazon Prime and Hulu.

To understand what’s going on I think it is important to start to make a first distinction in the definition of video streaming:

- TV streaming over the web, the international success of Netflix has been radically changing the TV industry forever.

- Live streaming on social networks with Snapchat and Facebook leading the pack has brought the capability of producing live news into the hands of anybody with a social media account.

In this article I will deal with the first definition and I will come back to live streaming in a later article.

TV streaming over the web

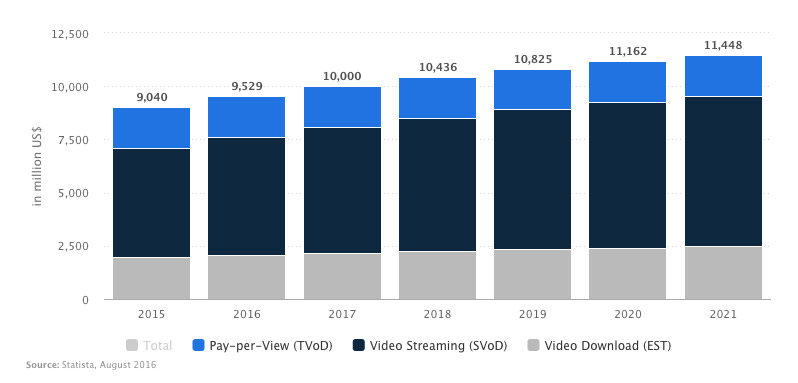

According to Statista.com, only in the US the revenue of the video-on-demand segment will reach US$10B in 2017 and it is expected to grow with 3.4 % CAGR (2017-2021) to an estimated of US$11.5BN in 2021. This market’s largest segment is video streaming which accounts for US$5,914m in 2017.

Netflix and Amazon have been positioning themselves very quickly to take advantage of digital video’s impressive growth in recent years, their keys to their success have been essentially two: original programming and a clear growth strategy.

The takeover of original programming by these two new comers has been anything short of astonishing. Their names now are mentioned at all major Hollywood awards. Just last month Amazon and Netflix each earned five Golden Globe nominations for TV series. In 2016 Netflix has received more Emmy nominations than ABC, CBS or NBC, while Amazon has received nominations for two movies: “Manchester by the Sea” and “The Salesman” for the upcoming Academy Awards.

As regards growth strategy Netflix and Amazon seem to be following slightly different paths.

In 2016 Netflix has successfully widened its reach to international markets. According to a recent announcement by the company, they have added 2 million subscribers in the USA and 5 million internationally just in the 4th quarter of 2016. These results beat analysts expectations by a large margin, not a common feat in such a competitive ecosystem!

Amazon Prime Video has chosen a different path to growth by aiming at sports audiences. In recent months the Internet giant has been in talks with NBA, NFL and Major League Baseball, as well as Major League Soccer and other minor leagues to acquire digital video streaming rights. Let’s see if they will be able to work their magic also in the tough arena of sports television rights.

Anyway, Netflix and Amazon should not be sleeping on their laurels. The second half of 2016 has seen the closing of several strategic deals which will have an enormous impact in the future of television.

Recent strategic moves

Facebook announces that it will produce original shows

This definitely gave the heebeegeebees to all media companies from ABC to Google and Netflix. Since its beginning Facebook has been aggressively set on its own path to growth rapidly adapting to trends and innovating. Just consider how in recent months they have been steamrolling rival Snapchat

According to Ricky Van Veen, global creative strategy chief, the plan for video is to “[…] To kickstart an ecosystem of partner content for the tab, so we’re exploring funding some seed video content, including original and licensed scripted, unscripted, and sports content, that takes advantage of mobile and the social interaction unique to Facebook.”

CBS, Disney and Fox signed up for Google’s Unplugged

Youtube is still the leader in digital video, but as we have just seen, Facebook could soon be a strong rival and not only for vlogger traffic. On the other hand, Netflix and Amazon have been successfully occupying the huge streaming fiction section to audience and critical acclaim.

In order to fend off competition in this growing market, YouTube plans to launch an Unplugged channel which will bundle several existing television channels. CBS was the first major media company to sign up for this project which is rumored to launch as early as this month. By repackaging existing content and pricing it at $40 a month, Unplugged will compete essentially against cable companies and other cablelike digital streaming services like DirectTV Now, rather than producing original programming like Netflix and Amazon Prime.

Hulu: more tv streaming

Owned by Comcast, Disney, Fox, NBC-Universal and Time Warner, Hulu was supposed to be their spearhead into the new world of television on demand, but so far it has fared worse than its direct competitors, as shown by this

After a big dip in popularity in 2015, Hulu has been slowing regaining some market share and is currently preparing to launch …. another digital television streaming service, of course! Hulu’s CEO Mike Hopkins announced last January that they have signed deals to include networks like ABC, ESPN and Fox News. Some of the most popular cable channels of the same parent companies such as popular channels like NBC, Fox, the Disney Channel, CNN, TNT, TBS, Cartoon Network and National Geographic are also expected to be included.

After a big dip in popularity in 2015, Hulu has been slowing regaining some market share and is currently preparing to launch …. another digital television streaming service, of course! Hulu’s CEO Mike Hopkins announced last January that they have signed deals to include networks like ABC, ESPN and Fox News. Some of the most popular cable channels of the same parent companies such as popular channels like NBC, Fox, the Disney Channel, CNN, TNT, TBS, Cartoon Network and National Geographic are also expected to be included.

Conclusions

These developments by Hulu and its prominent media backers as well the new ventures by YouTube and all the other media juggernauts seem to be missing the point and ignore the lesson they should have learned with the dip they suffered just when Netflix and Amazon take flight should have pointed them to the right direction.

A part from Facebook all these new services are just repackaging tv programs as-they-are to be distributed on another medium: the web. The big media companies are betting that the availability of the very same programs (and ads) on the untethered screens will allow them to maintain and increase their viewership. However, they are completely ignoring the two main points of appeal of video subscription: the lack of ads and the low price.

Media companies are positioning themselves for a long term game to catch cable viewers switching to the web. Emarketer forecasts that by 2019 cord-cutters will be 1 in 5 US households.

If my math is correct all these streaming television ventures are going to fight over less than 3M viewers, in the next two years. Indeed, it is a very long term game, and one that could easily be disrupted by any new technology, app, social network.

In the current economic climate how many of those cord-cutters will be willing to pay US$40 monthly, when they can watch equally great shows on Netflix and similar services at a fraction of the cost? Considering also the viewing habits of youth and teenagers who definitely favor web-based video distribution by micro-influencers, the outlook is not good for advertising supported television. While advertisers are moving their budgets to the web, with these numbers television streaming via Internet certainly is not going to be at the top of their budgets.

Television viewing habits will change profoundly in this generation, sticking to old revenue models will not cut it.